Eurozone Crisis: Beggar Thyself and Thy Neighbour

The crisis facing the eurozone looks at first sight as German efficiency clashing with Portuguese, Irish, Greek and Spanish sloppiness. But in many respects Germany has performed worse than the ‘peripheral’ countries in the last decade. The largest economy of the eurozone has been marked by slow growth, poor domestic demand, weak investment, high unemployment, and minuscule productivity gains. In fact, the only area in which Germany has excelled is exports, where it has chalked up large surpluses, while peripheral nations have had correspondingly large deficits. Meanwhile, productivity in the peripheral countries has actually risen faster than in Germany.

So if not a story of the lazy getting their just desserts, what then? There are two related reasons for the crisis: first, the precarious integration of peripheral countries in the eurozone, and, second, the crisis of financialization of 2007-09. The corollary of both phenomena has been to force the pressures of economic adjustment onto the labour market. Workers have lost out to capital across the eurozone. Guided by EU policy, eurozone countries have entered a ‘race to the bottom’ encouraging flexibility, wage restraint, and part-time work.

Two policy alternatives are available which attempt to shift the adjustment burden back onto capital. The ‘good euro’ option entails relaxing fiscal constraints, introducing an enlarged European budget, guaranteeing a minimum wage, and providing unemployment insurance. A more radical alternative would be ‘progressive exit’ from the eurozone, centred on the nationalization of banks and other key areas of the economy as well as the introduction of industrial policy. Under all circumstances, peripheral countries face hard choices involving social conflict.

Two policy alternatives are available which attempt to shift the adjustment burden back onto capital. The ‘good euro’ option entails relaxing fiscal constraints, introducing an enlarged European budget, guaranteeing a minimum wage, and providing unemployment insurance. A more radical alternative would be ‘progressive exit’ from the eurozone, centred on the nationalization of banks and other key areas of the economy as well as the introduction of industrial policy. Under all circumstances, peripheral countries face hard choices involving social conflict.

Malfunction in the Eurozone

The institutional mechanisms surrounding the euro have played an integral role in the crisis due to the mix of monetary, fiscal, and labour market policies they have produced. European monetary union is supported by a host of institutions, treaties and multilateral agreements which collectively have served to protect the interests of finance while simultaneously weakening the position of labour with respect to capital.

Under the auspices of European Central Bank (ECB), a single monetary policy – with the sole objective of preventing inflation – has been applied across the eurozone. This policy focus has precluded the possibility of the ECB acquiring and managing state debt, preventing the coordination of monetary policy with government spending. It has also resulted in the ECB failing to take action against damaging financial speculation against member states. The ECB has played a central role in protecting financial interests and facilitating financialization in the eurozone.

Fiscal policy has been placed under the tight constraints of the Stability Pact, with fiscal discipline vital to the position of the euro as an international reserve currency. Since it lacks a unitary state and polity, the eurozone has not had an integrated tax system or fiscal transfers between areas. In practice, fiscal rules have been applied with some laxity in core countries and elsewhere. Peripheral countries have attempted to disguise budget deficits in a variety of ways. Nonetheless, fiscal stringency has prevailed during this period.

Given these constraints, national competitiveness within the eurozone has depended on the conditions of work and the performance of labour markets, and in this regard EU policy has been unambiguous. The European Employment Strategy has encouraged greater worker flexibility in the form of more part-time and temporary employment. The considerable downward pressure on pay and conditions has meant a race to the bottom across the eurozone. The actual application of this policy across the eurozone has varied depending on welfare systems, trade union organization, and social and political history yet workers everywhere increasingly suffer under intensified competitive constraints.

Gains for German Capital, Losses for German Workers and the Periphery

Peripheral countries joined the euro at generally high rates of exchange presumably to control inflation, thus signing away some of their competitiveness at the outset. Since monetary policy has been set by the ECB and fiscal policy has been constrained by the Stability Pact, peripheral countries were encouraged to improve competitiveness primarily by applying pressure on workers within their borders. These societies have faced two major problems in this regard. First, real wages and welfare states are generally worse in the periphery than the core of the eurozone. The scope for gains in competitiveness through pressure on workers is correspondingly less. Second, Germany has been unrelenting in squeezing its own workers throughout this period. During the last two decades, the most powerful economy of the eurozone has produced the lowest increases in nominal labour costs, while its workers have systematically lost share of output. European monetary union has been an ordeal for German workers.

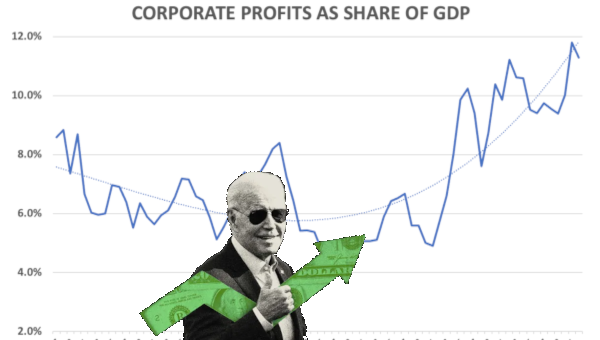

German competitiveness has thus risen further within the eurozone. The result has been a structural current account surplus for Germany, mirrored by current account deficits for peripheral countries. This surplus has been the only source of dynamism for the German economy throughout the 2000s. In terms of output, employment, productivity, investment, consumption, and so on, German performance has been mediocre. Thus, at the core of the eurozone lies an economy that delivers growth through current account surpluses deriving in large part from the arrangements of the euro. German surpluses, meanwhile, have been translated into capital exports – primarily bank lending and foreign direct investment – the main recipient of which has been the eurozone, including the periphery.

This is not to imply that workers in peripheral countries have avoided pressures on pay and conditions. Indeed, the share of labour in output has declined across the periphery. It is true that the remuneration of labour has increased in nominal and real terms in the periphery, but productivity has risen by more – and generally faster than in Germany.

But conditions within the eurozone have not encouraged rapid and sustained productivity growth in peripheral countries, partly due to middling levels of technology, with the exception of Ireland. Peripheral countries have thus lost competitiveness as the nominal compensation of German workers has remained practically stagnant throughout the period.

Confronted with a sluggish but competitive Germany, peripheral countries have opted for growth strategies that reflected their own history, politics and social structure. Greece and Portugal sustained high levels of consumption, while Ireland and Spain had investment booms that involved real estate speculation. Across the periphery, household debt rose as interest rates fell. The financial system expanded its weight and presence across the economy. But in 2009-10 it became apparent that these strategies were incapable of producing long-term results.

Finance Creates a Crisis and then Takes Advantage of it

The immediate causes of the crisis of 2007-09 lay in the U.S. mortgage bubble which became global due to securitization of subprime assets. European banks began to face liquidity problems after August 2007, and German banks in particular found that they were heavily exposed to problematic, subprime-related securities. During the first phase of the crisis, core eurozone banks continued to lend heavily to peripheral borrowers in the mistaken belief that they were a safe outlet. Net exposure rose substantially in 2008.

Yet reality had changed dramatically for banks as liquidity became increasingly scarce in 2008, particularly after the ‘rescue’ of Bear Sterns in early 2008 and the collapse of Lehman Brothers six months later. To rescue banks, the ECB engaged in extensive liquidity provision, accepting many and debatable types of paper as collateral for secure debt. ECB actions allowed banks to begin to adjust their balance sheet, engaging in de-leveraging. By late 2008 banks were already reducing their lending, including to the periphery. Banks also stopped buying long-term securities preferring to hold short-term instruments – backed by the ECB – with a view to improving liquidity. The result was credit shortage and accelerated recession across the eurozone, including the periphery.

These were the conditions under which states – both core and periphery of the eurozone but also the UK and other states – began to seek additional loanable funds in financial markets. A major cause of rising state borrowing was the decline of public revenue as recession lowered the tax intake. State expenditure also rose in several countries after 2007 as the rescuing of banks proved expensive, and to a lesser extent as states attempted to support aggregate demand. Accelerated public borrowing in 2009 was induced by the crisis, and hence by the earlier speculations of the financial system. In this respect, the Greek state was typical of several others, including the USA and the UK.

In the conditions of financial markets in 2009, with the banks reluctant to lend, the rising supply of state paper put upward pressure on yields. Thus, speculators found an environment conducive to their activities. In the past, similar pressures in financial markets would have led to speculative attacks on currencies and collapsing exchange rates for the heavy borrowers. But this was obviously impossible within the eurozone, and hence speculative pressures appeared as falling prices of sovereign debt.

Speculators focused on Greek public debt on account of the country’s large and entrenched current account deficit as well as because of the small size of the market in Greek public bonds. Credibility was also lost by the Greek government because of systematic fiddling of national statistics to reduce the size of budget deficits. But the broader significance of the Greek crisis was not due to the inherent importance of the country. Rather, Greece represented potentially the start of speculative attacks on other peripherals – and even on countries beyond the eurozone, such as the UK – that faced expanding public debt.

The Greek crisis, therefore, is symptomatic of a wider malaise. It is notable that the institutions of the eurozone, above all the central bank, have performed badly in this context. For the ECB private banks were obviously ‘too big to fail’ in 2007-09, meriting extraordinary provision of liquidity. Still there was no similar sensitivity toward peripheral countries that found themselves in dire straits. It made little difference that the problems of public debt were largely caused by the crisis as well as by the very actions of the ECB in providing banks with liquidity.

To be sure the ECB has been hamstrung by its statutes which prevent it from directly acquiring public debt. But this is yet more evidence of the ill-conceived and biased nature of European monetary union. A well-functioning central bank would not have simply sat and watched while speculators played destabilising games in financial markets. At the very least, it would have deployed some of its ingenuity, as the ECB generously did when private banks needed liquidity in 2007-09. And nor would it have decided what types of paper to accept as collateral on the basis of ratings provided by the discredited private organizations that were instrumental to the bubble of 2001-07.

Alternatives for Peripheral Countries:

‘Good Euro’ or ‘Progressive Exit’?

The crisis is so severe that there are neither soft options, nor easy compromises for peripheral countries. The first alternative is to reform the eurozone. There is almost universal agreement that unitary monetary policy and fragmented fiscal policy have been a dysfunctional mix. There is also widespread criticism of the ECB for the way it has provided abundant liquidity to banks, while keeping aloof of borrowing states, even to the extent of ignoring speculative attacks.

A radical reform programme would include the abolition of the Stability Pact and altering the statutes of the ECB to allow it regularly to lend to member states. The aim of such reform would be to retain monetary union, while creating a ‘good euro’ that would be beneficial to working people. The ‘good euro’ strategy would involve significantly expanding the European budget to deliver fiscal transfers from rich to poor countries. There would be an active European investment strategy to support new areas of economic activity. There would also be a minimum wage policy, reducing differentials in competitiveness, and lowering inequality across the eurozone.

The ‘good euro’ strategy, appealing as it sounds, would face two major problems. The first is that the eurozone lacks a unitary state, and there is no prospect of acquiring one in the near future, certainly not with the required progressive disposition. The current machinery of the eurozone is entirely unsuited to this task. The strategy would face a continuous conflict between, on the one hand, its ambitious pan-European aims and, on the other, the absence of state mechanisms that could begin to turn these aims into reality.

More complexly, the ‘good euro’ strategy would clash with the putative role of the euro as world money. If fiscal discipline was relaxed among member states, there would be a risk that the value of the euro would collapse in international markets. Were that to happen, at the very least, the international operations of European banks would become extremely difficult. The international role of the euro, which has been vital to the project from the beginning, would come under heavy pressure. Thus, it is not clear that the ‘good euro’ strategy is compatible with monetary union. In this light, a ‘good euro’ might end up as ‘no euro.’

The second alternative is ‘progressive exit’ from the eurozone (as distinct from a ‘conservative exit’, which is increasingly discussed in the Anglo-Saxon press). This would require a shift of economic and social power toward labour in peripheral countries. There would be devaluation accompanied by cessation of payments and restructuring of debt. To prevent collapse of the financial system there would have to be widespread nationalization of banking, creating a system of public banks. Controls would also have to be imposed on the capital account to prevent outflows of capital. To protect output and employment, finally, it would then be necessary to expand public ownership over key areas of the economy, including public utilities, transport and energy.

On this basis, it would be possible to develop industrial policy that could combine public resources with public credit. There are broad areas of the national economy in peripheral countries that call for public investment, including infrastructure. Opportunities exist to develop new fields of activity in the ‘green economy.’ Investment growth would provide a basis on which to improve productivity, ever the Achilles heel of peripheral economies. Financialization could then begin to be reversed by lessening the relative weight of finance.

A radical policy shift of this type would require transforming the state by establishing mechanisms of transparency and accountability. The tax and transfer payments of the state would then take a different shape. The tax base would be broadened by limiting tax evasion by the rich as well as by capital. Public provision for health and education would be gradually improved, as would redistribution policies to alleviate high inequality in peripheral countries.

A policy of progressive exit for peripheral countries would come with evident costs and risks. The broad political alliances necessary to support such a shift do not exist at present. This absence, incidentally, is not necessarily due to lack of popular support for radical change. More important is that no credible political force in Europe has had the boldness to oppose austerity hitherto. Beyond political difficulties, a major problem for progressive exit would be to avoid turning into national autarky. Peripheral countries are often small and need to maintain access to international trade and investment, particularly within Europe. They also need technology transfer. International alliances and support would be necessary in order to sustain flows of trade, skills and investment. These would be far from easy to secure if the rest of the EU remained under the spell of monetary union. But note that progressive exit by the periphery would also offer fresh prospects to core eurozone countries, particularly to labour which has suffered throughout this period.

There would be costs to any form of radical strategy, to be sure, but they would be borne equitably. Unlike the option of austerity, furthermore, radical change would have the potential to put the economy on a sustainable path of development that produced benefits for all. The choice belongs to society and, as always, depends on struggle. •

This report was prepared by C. Lapavitsas, A. Kaltenbrunner, D. Lindo, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors and N. Teles. For the full Eurozone Report, please visit the SOAS Research on Money and Finance website at www.soas.ac.uk/rmf.